PROTECTION

You work hard to grow your assets, let’s make sure we protect them as well. Protection and risk management are essential to any comprehensive financial plan. Too often, families only plan for if everything goes according to the plan, and don’t consider the impact that a loss of income, due to death or disability, can have on their finances. The greatest asset that you provide your family is your ability to continue working to generate an income. Many times, we find that insurance can be utilized as a successful estate planning vehicle, therefore it is important to share your goals and objectives so that we can recommend a suitable investment for your situation.

You work hard to grow your assets, let’s make sure we protect them as well. Protection and risk management are essential to any comprehensive financial plan. Too often, families only plan for if everything goes according to the plan, and don’t consider the impact that a loss of income, due to death or disability, can have on their finances. The greatest asset that you provide your family is your ability to continue working to generate an income. Many times, we find that insurance can be utilized as a successful estate planning vehicle, therefore it is important to share your goals and objectives so that we can recommend a suitable investment for your situation.

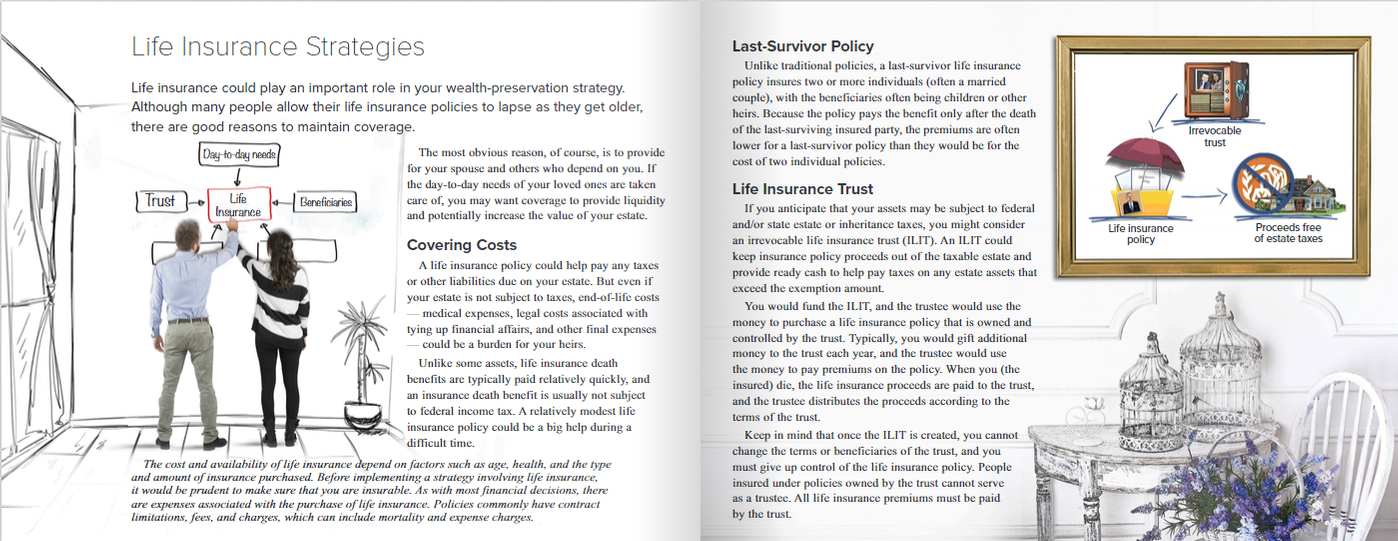

Life insurance:

Life insurance provides the peace of mind that your family is protected if something happens to you. Some types of life insurance are temporary, providing coverage for a set period of time while others provide permanent death benefit protection.

Life insurance provides the peace of mind that your family is protected if something happens to you. Some types of life insurance are temporary, providing coverage for a set period of time while others provide permanent death benefit protection.

Term policies: Protection that lasts for a specific period, such as 10, 20, or 30 years. Term coverage is ideal for a temporary need, such as providing funds that could pay off a mortgage or replace income for your family.

Permanent policies: Protection that lasts for a lifetime. In addition to providing a death benefit, permanent policies may build up cash value that can be accessed during the insured’s lifetime. There are no restrictions on what the cash value can be used for, giving you flexibility to accomplish your goals.

Our advisors will educate you on the different types of life insurance, the benefits and shortcomings of each, to create a plan that has the proper coverage for your situation.

Life Insurance cost 3x less than most people think 1

Disability:

83% of working Americans place a priority on providing for their family if they are unable to work. 2

Disability policies protect against the event that you are unable to work for an extended period of time due to your health. Certain policies only provide coverage if you’re unable to work your specific job, while others provide benefits if you cannot perform any job. You could potentially run the risk that you’re not healthy enough to hold your own job, but the terms of your disability policy state that you’re healthy enough for any job, and disability coverages could be denied. Our advisors will coordinate with any coverage offered through your employer to determine if additional disability insurance is necessary.

Disability policies protect against the event that you are unable to work for an extended period of time due to your health. Certain policies only provide coverage if you’re unable to work your specific job, while others provide benefits if you cannot perform any job. You could potentially run the risk that you’re not healthy enough to hold your own job, but the terms of your disability policy state that you’re healthy enough for any job, and disability coverages could be denied. Our advisors will coordinate with any coverage offered through your employer to determine if additional disability insurance is necessary.

Estate Planning:

Estate management is foundational to any financial plan, enabling you to manage your affairs during your lifetime and control the distribution of your wealth after death. It allows you to be intentional about who will receive your assets and in what manner. It also allows you to be thoughtful about your own care and choose who will manage your finances should you become unexpectedly disabled. At the core, we recommend client implement the following:

Estate management is foundational to any financial plan, enabling you to manage your affairs during your lifetime and control the distribution of your wealth after death. It allows you to be intentional about who will receive your assets and in what manner. It also allows you to be thoughtful about your own care and choose who will manage your finances should you become unexpectedly disabled. At the core, we recommend client implement the following:

- Living trust

- Will

- Assignment of Assets

- Durable Power of Attorney

- Health care documents

Estate planning should be an ongoing process, not a one-time event, the people and things you care about change over time. Having an estate plan can ensure you are giving to the people and causes that are most important to you. without an estate plan your assets may not transfer to who you would like them to, as legatees are determined by state law. Additionally, estate taxes may impact your beneficiaries’ inheritance in an unexpected and potentially avoidable way – leaving loved ones with much less than you originally intended. Fortunately, with the proper planning, you can easily mitigate or avoid many of these potentially negative consequences. We want you to be able to maximize your legacy goals, transferring your wealth, not your taxes. Our estate planning partners will work with you to develop a plan to help you achieve your legacy goals in the most efficient way. It’s you and your family’s goals that drive the estate planning process, we are here to help!

68% of Americans do not have a valid will. 3

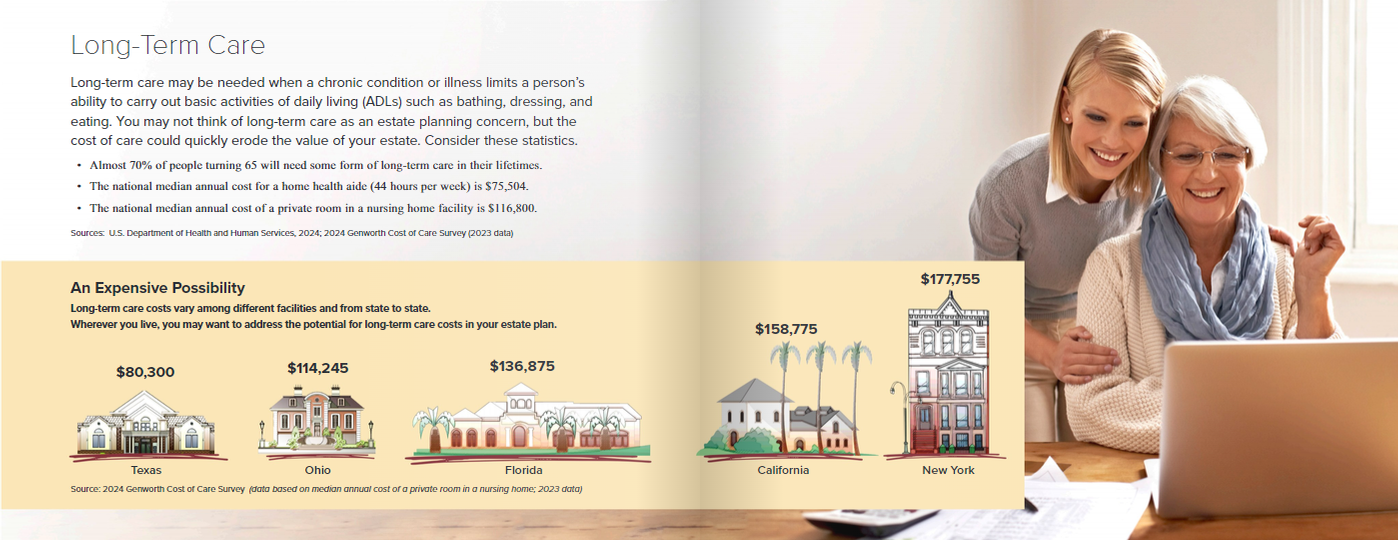

Long Term Care:

Fact 70% of people who reach age 65 are expected to need some form of long-term care at least once in their lifetime. 4

Most people do not like to think about the possibility of needing long-term care. But as we get older, the likelihood that we will need some kind of assistance is very real.

Most people do not like to think about the possibility of needing long-term care. But as we get older, the likelihood that we will need some kind of assistance is very real.

Long-term care is a range of services and supports you may need to meet your personal care needs. Most long-term care is not medical care, but rather assistance with the basic personal tasks of everyday life, otherwise known as activities of daily living, such as:

- Bathing

- Dressing

- Using the toilet

- Transferring (to or from bed or chair)

- Caring for incontinence

- Eating

Long-term care cost vary based on the amount and type of care you need and where you get it. As with other retirement planning you’ve done, long-term care should fit your personal situation. You’ll need to balance what you can afford, the kind of care you expect, and the risks you might face.

1 Source: Forbes Advisor 2023 Life Insurance Survey

2 Source: LIMRA Life Insurance Barometer Study, 2021

3 Source: ¹Cambridge Trust ²WealthCounsel ³LegalZoom °Trust & Will °°Age Wave/Merrill †SeniorLiving.org Bequest Intentions and Race — PDF Download (Jennifer Lehman, JD, PhD & Russell James, JD, PhD, CFP)

4 Source: LongTermCare.gov